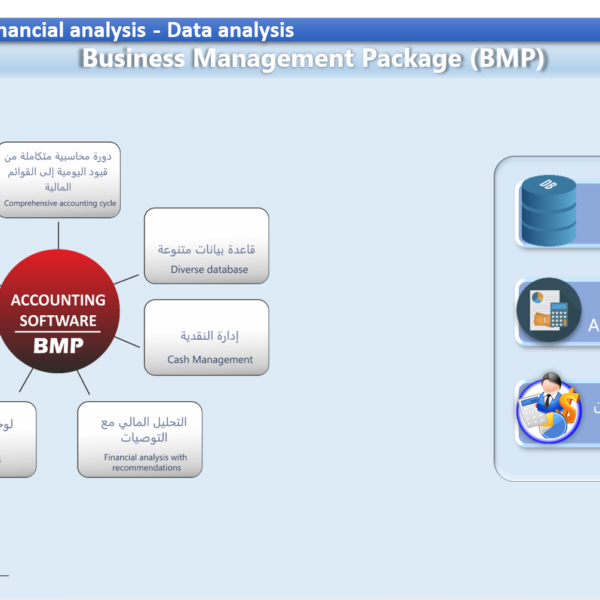

Financial and credit analysis is a vital tool that helps companies assess their financial performance and explore the opportunities and risks surrounding their financial decisions. This application is designed to provide a comprehensive view of a company’s financial performance through analyzing profitability, liquidity, risk, and financing structure indicators. The application relies on advanced financial models that help determine the company’s financial stability level and offers detailed reports on financial performance over the years.

In addition to financial analysis, the application includes tools for evaluating credit decisions by comparing the current and required credit status, and estimating expected returns against potential costs. This provides a solid information base that supports strategic decision-making grounded in precise financial principles, thereby enhancing the company’s competitiveness and ensuring financial sustainability.

### 1. General Application for Financial and Credit Analysis

The application aims to provide comprehensive analyses of a company’s financial performance, including profitability, liquidity, financing structure, and risk indicators. It displays information on the company’s financial performance over the years, identifying strengths and weaknesses that help in making strategic financial decisions.

The application includes multiple metrics such as return on investment, return on equity, turnover rate, and coverage ratio to accurately assess the company’s financial status.

### 2. Financial Position Analysis

It provides a summary of the company’s financial position through analyzing assets, liabilities, and equity. Assets and liabilities are displayed in a chart showing the percentage of each key component, offering a quick and comprehensive view of the overall financial position.

### 3. Performance Ratios

Includes a set of key financial ratios such as inventory turnover, average collection period, receivables turnover, and operating cycle. These ratios help evaluate the efficiency of the company’s operational and financial management.

### 4. Financing Structure

Displays the company’s financing structure, including equity, short-term, and long-term loans. This analysis helps understand the ratio of self-financing versus debt financing and assesses the company’s reliance on debt to fund its activities.

### 5. Risk Ratios

Includes important indicators such as debt ratio, interest coverage ratio, and cash flow to debt ratio. These ratios indicate the level of risk associated with the company’s debt and its ability to meet financial obligations.

### 6. Sherrord Model for Credit Evaluation

Used to assess the company’s credit position and determine the level of risk. This model indicates whether the company’s credit position is stable or requires intervention to mitigate potential risks.

### 7. Bankruptcy Prediction Model (Z-Score)

This model relies on several indicators to evaluate the likelihood of the company facing bankruptcy in the future. It helps in making quick decisions to protect the company from bankruptcy risks.

### 8. Growth Analysis Over Financial Years

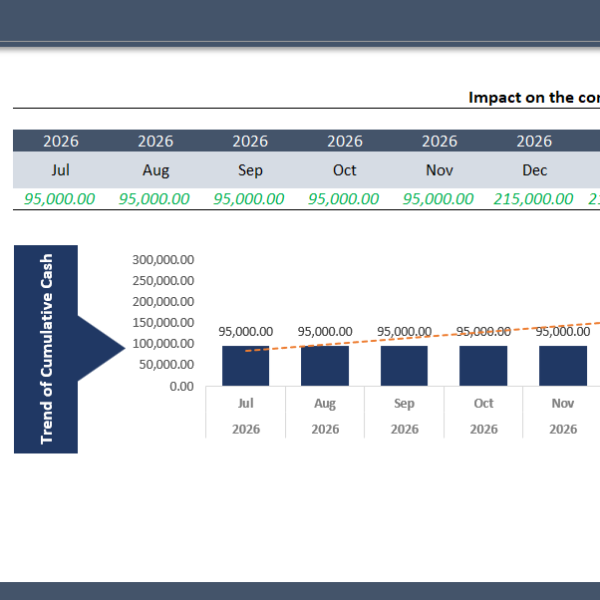

Displays annual revenue, net income, and growth rates across financial years in a chart. This analysis helps understand key financial trends and determine if the company is achieving sustainable financial growth.

### 9. Credit Decision Analysis

This section provides a comprehensive analysis of credit decisions by comparing the current and required credit status of the company. It analyzes expected changes in customer balance, credit cost, and profitability of sales increases.

A summary of results is provided with a recommendation based on the expected return from raising the credit limit versus the anticipated cost. The required rate of return (RRR) and the weighted average cost of capital (WACC) are calculated to give a final recommendation on granting credit.

This application provides a comprehensive and user-friendly interface for analyzing all financial and credit aspects, helping companies make strategic decisions that support financial sustainability and reduce potential risks.